“We don’t sell performance. We sell discipline.”

As we have been warning for the past several months, the market volatility has picked up, and we do not see it decreasing any time soon. For over a year, we have been methodically reducing the risk levels in your portfolio to prepare for the oncoming storm. We are not panicking over market moves. We have been following our disciplined approach and moving you to safer ground. For many years, it has been the practice of our Investment Team to meet at least every Wednesday to review our current portfolios. In preparation for each meeting, we study investment analysis, market trends, and global economic guidance from our favored objective analysts. Speaking of analysts, we are very fortunate to have Vy Nguyen as our Investment Counsel. Vy has been a member of our Investment Team for nearly a year now and is taking on an increasing role in helping guide our investment choices. Vy has a PhD in Economics and is on the verge of finalizing her Chartered Financial Analyst (CFA) designation. The following is Vy’s research and guidance on how we should invest going into this very volatile market: What Happened Since the Beginning of the Year

The turning of the stock market year-to-date can be attributed in large part by the Fed’s decision to pause rate hikes. What this means for the economy is that the rate pause gives the economic expansion a little more time before a hard hit. Corrections like this week should become more common. We believe the view of a goldilocks scenario, a soft landing without a recession before another cycle of economic expansion, is naïve. While the timing of a recession is extremely difficult to predict, we see an increasing risk stemming from the corporate debt bubble that continues to be inflated. Yes, we have had some good economic news of a low unemployment rate and stronger than expected GDP growth rate (3.2% annualized) in the first quarter.

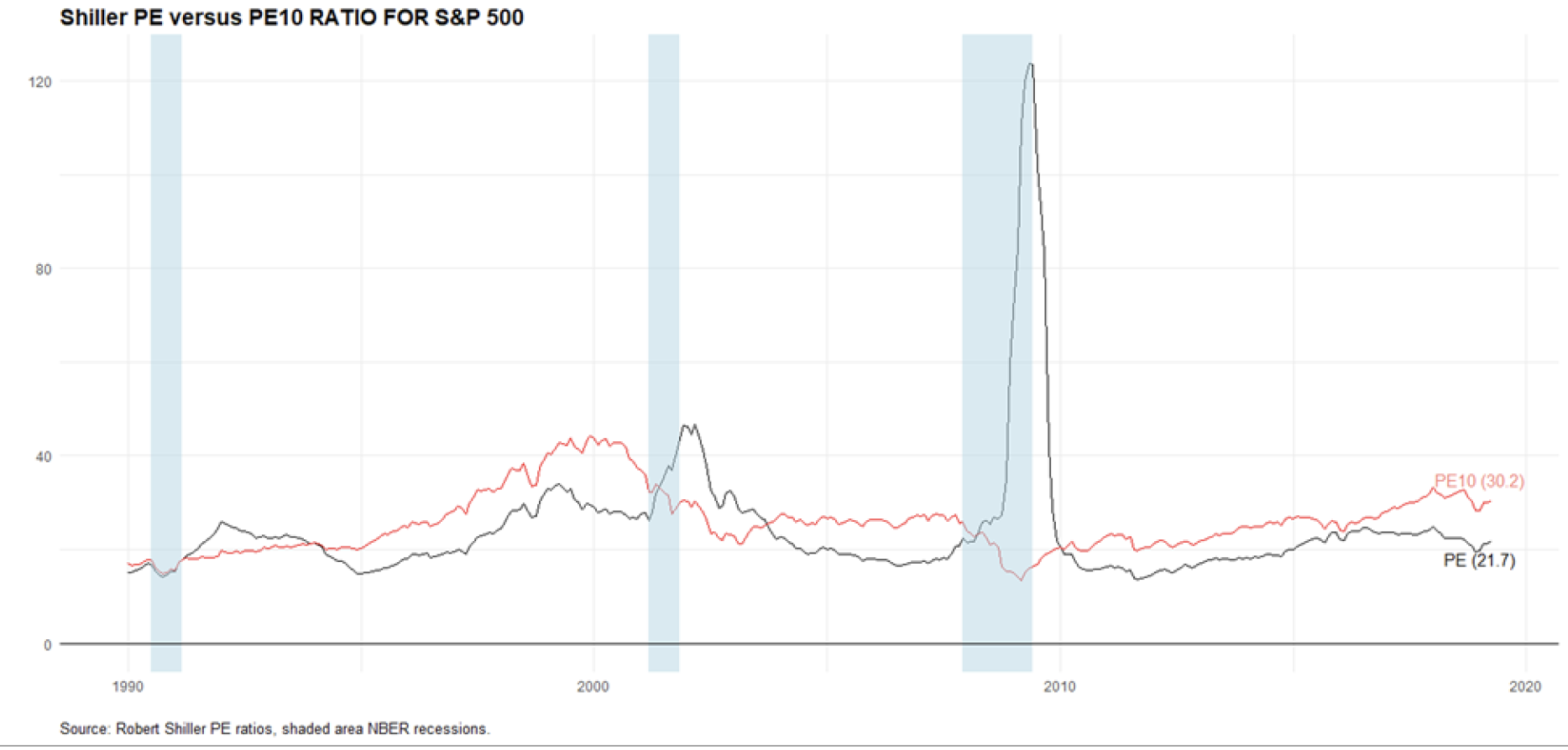

However, sales to domestic private buyers, the core driver of US economic growth, increased at a rate of 1.2%, much lower than that of the aggregate GDP growth. Earnings reports for the first quarter are showing that more companies are beating analysts’ expectations than the long-term average. Yet following the December stock market selloffs, analysts widely revised their expectations of earnings growth from positive to negative, making it much easier to jump the bar. The trailing 12-month price-to-earnings (PE) ratio of the S&P 500 is currently close to its median level since 1990. However, when adjusting for the cyclical nature of earnings, the current price of S&P 500 is highly overvalued, with PE10 ratio at 30.2 (Source: Robert Shiller and his book Irrational Exuberance for historic S&P 500 PE Ratio). The divergence of PE and PE10 have typically preceded previous recessions.

The Investment Strategy from Here

We continue to be moderately conservative with our strategic asset allocation and continue our quarterly rebalancing to keep your risk levels in check. We believe that the Fed has likely finished its rate hikes during this economic cycle, with inflation during the first quarter remaining subdued. While the market is pricing in a rate cut this year, we believe that a modest steepening is possible, if the economic backdrop continues at its pace. While we have gained from increasing our quality and duration of our fixed income holdings earlier in the year, we are looking to reallocate our fixed income holdings from the middle– to the short-end of the curve. In the equity arena, we continue to favor quality, larger-sized, and high-dividend yielding stocks. We currently see value in the health care sector, which is still generating about 22% return on equity and is more defensive to recession risk. We are slow to move back into the global equity space, but we see value in UK financials, even in the event of an uncontrollable Brexit.

Please remember that past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by 1NWS), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from 1NWS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. 1NWS is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of 1NWS’s current written disclosure statement discussing our advisory services and fees is available upon request.