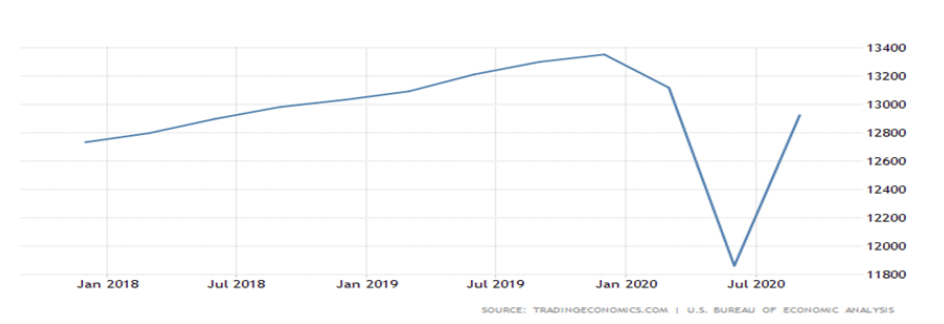

After a soft first quarter, we have a positive outlook for 2021. As the vaccine becomes widely available, we are expecting a strong acceleration in the second half of the year as people start to engage in the activities that they were unable to in 2020. This will be especially positive for the entertainment, travel, and leisure industries.

We will face near-term market challenges globally. With the resurgence in virus cases, we feel that the 1st quarter of 2021 will be a slow growth period. Policy fatigue risks are rising, especially in the U.S., but continuing policy support is essential to limit permanent economic damage. Positive vaccine news has and will provide clarity for policymakers and markets to move ahead in a postpandemic world. As more people receive the vaccine into the 2nd quarter and beyond, we are expecting a strong resurgence in consumer spending as pent up demand for products and services that were unavailable or limited during the pandemic are once again accessible.

As market conditions improve, we have been slowly moving away from defensive sectors (consumer staples, some healthcare, utilities) and will be putting the money to work in cyclical sectors (consumer cyclicals, industrials, materials).

The central banks will continue to curb nominal yields and let the economies run hot, even as inflation risks rise. Inflation will have different consequences than it has in the past. Normally, rising inflation is costly for investors because it leads to higher interest rates that depress stock valuations.

We have shortened duration on Treasuries, increased exposure to TIPS (treasuries that are inflation protected), and added short and intermediate investment grade credit and preferred securities.

The pandemic has put geopolitical changes on the fast-track, especially between the U.S. and China. Global supply chains are relying more on resilience than on efficiency. The rivalry between the U.S. and China will be here to stay with the core of the problem being competition in the tech center. Both countries will seek self-sufficiency in the foundational sectors of technology, such as semiconductors.

We are increasing our emerging market exposure with focus on countries with stronger fundamentals. We will also add developed market exposure as the market conditions improve.

Globally, the pandemic has accelerated structural and sustainability movements that were already in place: supply chain resilience; digitalization; green infrastructure; access to healthcare; and a transition to a low carbon footprint. The shop-from-home economy of the pandemic has opened the door for a handful of tech giants and the work-from-home economy will continue to offer new investment opportunities.

Throughout 2020, we invested in financial and cloud technologies, data storage real estate, and companies whose products and services are driving innovation and transforming the global economy. We will continue to look for these types of opportunities in 2021.

Our investment approach to 2021 will be less defensive than 2020. Realizing that there is a hopeful recovery ahead, though it may not necessarily be an easy one, we are positioning for global behavior shifts, both COVID-19 and geopolitical-related, by: