Determining when you should apply for Social Security benefit depends on many factors, starting with whether you plan to earn income up to age 70 (see below). We strongly recommend that you meet with us from age 61.5+ to review, at least annually, when to apply for your Social Security benefit. The start date to receive your Medicare benefit, however, is straightforward.

MEDICARE

Within 3 months before your 65th birthday, you can sign up to apply for your Medicare benefit. To do so, you have 2 choices:

- Contact HTA Financial: Take advantage of having a team of Medicare experts guide you

through the Medicare application. They will review your health coverage needs, complete your Medicare application, and help you choose the right Medi-gap plan based on your health needs. There is no cost for this service as they are paid by the health plan that you choose and have over 30 coverage options, so they are not biased by payment options. Please note that we are not paid by them either! You can reach HTA Financial at 610-430-6650. Please have your prescription details ready for your discussion with them.

- You can sign up through the Medicare website at https://www.ssa.gov/benefits/medicare. Once you create an account through the site (login.gov), you will enter your personal information and be guided through the site to request starting your Medicare benefit on your 65th birthday. If you have questions throughout this process, please contact our office and we’d be glad to assist you.

SHOULD YOU SIGN UP FOR MEDICARE PART B (OFFICE VISITS) AND PART D (PRESCRIPTIONS)?

First off, Part A (hospitalization) is free, so you will at least sign up for that. There are at least two reasons why you may choose to forego applying for Part B and Part D:

- If you are covered by a retiree health plan, your health coverage may cover most, if not all, of the coverages that Parts B&D provide; or

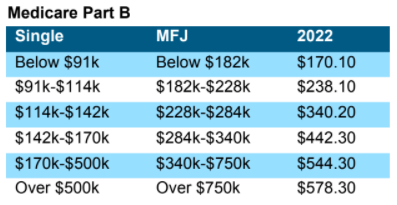

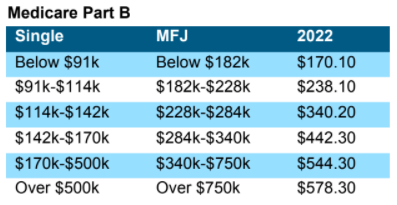

- If your adjusted gross income (AGI) is very high, the monthly cost may be too expensive for you. Medicare premiums are determined by your AGI; therefore, if yours is high, you may do better with a Medicare supplement coverage that covers Parts B&D as well or better than Medicare.

We will work with your tax advisor to estimate your annual taxable income. We also recommend that you check with your primary care doctor to review whether you need Medicare Part B vs. your existing Medicare supplement plan. We will review this annually with you, as will your HTA advisor.

SOCIAL SECURITY

Visit secure.ssa.gov/iclaim to start your Social Security benefit application. If you already have a login.gov ID and PW, you will be able log in with this info to save time. Once you are in, you will be prompted to choose a start date to receive your first benefit check. We strongly recommend that we determine the optimal start date together.

THE OPTIMAL START DATE

Basically, you have three dates to consider for starting this benefit: age 62; full retirement age (FRA); or age 70. Your FRA depends on your year of birth. If born before 1960, your FRA is 66+; if born after 1960, your FRA is 67. The main factors to consider are:

- Health: What is your life longevity? If you may not live beyond 78, it tends to be better for you to start your benefit as early as age 62, but no later than your FRA.

- Earnings: If you may earn more than $18,960 (indexed annually), your benefit would be reduced by 50% for all income earned about that threshold until your FRA year. After then, you can earn unlimited income with no reduction to your benefit.

- Cash Flow: If you need to use funds from your traditional IRA to meet expenses, it may be beneficial to start your benefit sooner to avoid higher taxation of income.

- Marital Status: If you are married and you don’t need your benefit to meet expenses, it tends to be optimal for the higher earning spouse to wait until age 70 while the lesser earning spouse begins no later than the FRA year. It is important to note that this strategy provides the surviving spouse with the higher benefit at the death of the other spouse. If you are single and never married, your decision rests mostly on your long-term health projection. If you are divorced, there are many decisions to consider, and we will review all options with you.

It can be beneficial to go in person to the local social security office (https://ssa.gov/locator) to have an

official review all available options, particularly if you are divorced and not remarried, have a dependent

under age 19, or are or were disabled and currently or formerly received disability social security payments.

You can set up an appointment with your local office once you create an account through login.gov.

DO WE BELIEVE YOU SHOULD COLLECT YOUR BENEFIT BEFORE SOCIAL SECURITY “DRIES UP?”

No, we do not believe that this benefit will be removed by 2032 or anytime soon after; however, we do believe that your benefit could be reduced based on your taxable income. Using the same income threshold chart that is currently used for Medicare (see reverse page), if your AGI is above $88k single/$176k MFJ, you could lose 20% or more of your benefit. We believe that it would take very little for Congress to add a means test to this benefit in the same way it currently has for Medicare. We will keep you updated on this possible change.

For each of these benefits, we are ready to guide you so that this process is smooth and painless. Please keep us updated on your health and income situation each year so that we can determine the optimal use of each of these benefits throughout your retiree lives.