For many years in this business, we have done a great deal of work in making sure our investments have strong fundamentals. What this means is that before we choose an investment, we take time to investigate the company’s balance sheets, financial statements, business practices, and leadership strategies. Additionally, we review a company’s actions around corporate governance. This means that we verify that these companies we invest in have a solid, transparent record, do not cut corners for profit sake, and do not have ethical violations. These are well-run, stable companies. Given the current market and geo-political situation, now more than ever, we want to make sure the companies we invest in have a solid balance sheet as well as a strong reputation. This isn’t simply because we know this is important to some of our clients—it is a measure to insulate, strengthen, and position our clients’ portfolios for success in what may prove to be an upcoming recession. In previous recessions, companies that spent money and time making sure their companies were solid performed better coming out of the recession than those that cut corners and had questionable labor practices. (Eaton Vance/Calvert January 2019) Mary Lu, Vy, and our investment team already do excellent work in screening possible investments for companies that receive high “governance” scores. The good news is that this trend is growing through Sustainable, Responsible, Impact (“SRI”) or Environmental, Sustainable, Governance (“ESG”) investing. We now have an array of great tools at our disposal to assist in finding excellent companies with these governance scores and we use this data as part of our process in choosing the companies (or ETFs/Funds) we invest in.

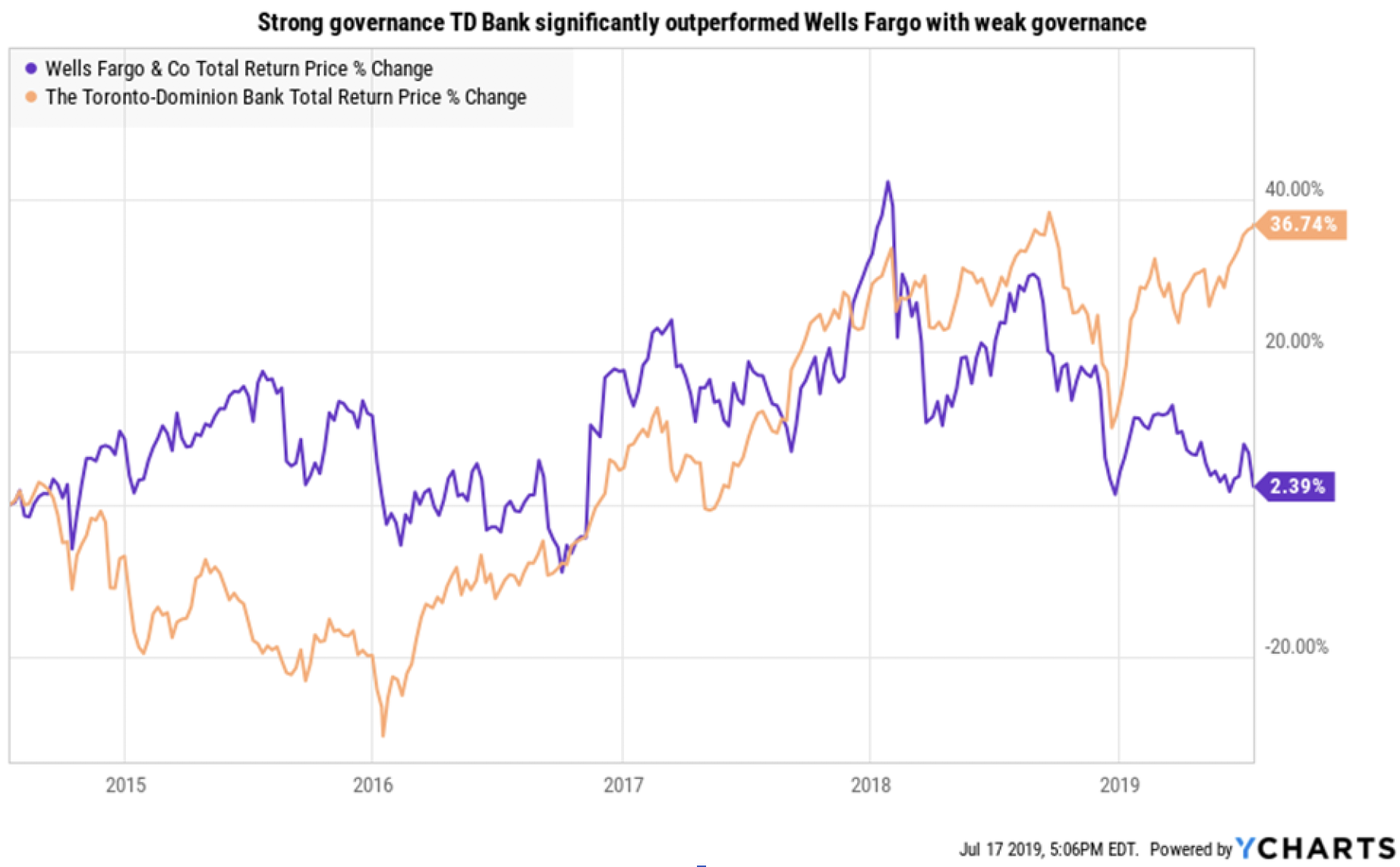

For example, in the Financial Sector, fraud tends to be the issue. In the past few years, no company has been in the news more than Wells Fargo (WFC). When we were researching the undervalued Financial Sector in the summer of 2015, several companies, including Wells, were a good value based on basic fundamentals; however, their corporate governance metrics were already weak. TD Bank (TD) was an equally well-valued company with much stronger corporate governance metrics and other fundamentals. We, therefore, chose TD and it has since out-performed Wells by over 64%, all while increasing its quarterly dividend by more than 20%.

As stated, ESG has become a growing trend among mutual fund companies looking to achieve a marketing edge. We are happy to review your current fund holdings with these other mutual funds to investigate what the corporate governance scores of the underlying companies truly are. Many have been found to have very poor scores but were kept in the account as a marketing tool. Thus, we encourage you to be mindful of what you are truly holding. Please note, corporate governance is just one facet of socially-responsible investing. If you would like to review other ways in which we can increase your portfolio’s social footprint, or if you have a particular passion or interest for themes you want to support or avoid, please let us know. We want to make sure your investment design aligns with your personal values.

Please remember that past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by 1NWS), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from 1NWS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. 1NWS is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of 1NWS’s current written disclosure statement discussing our advisory services and fees is available upon request.