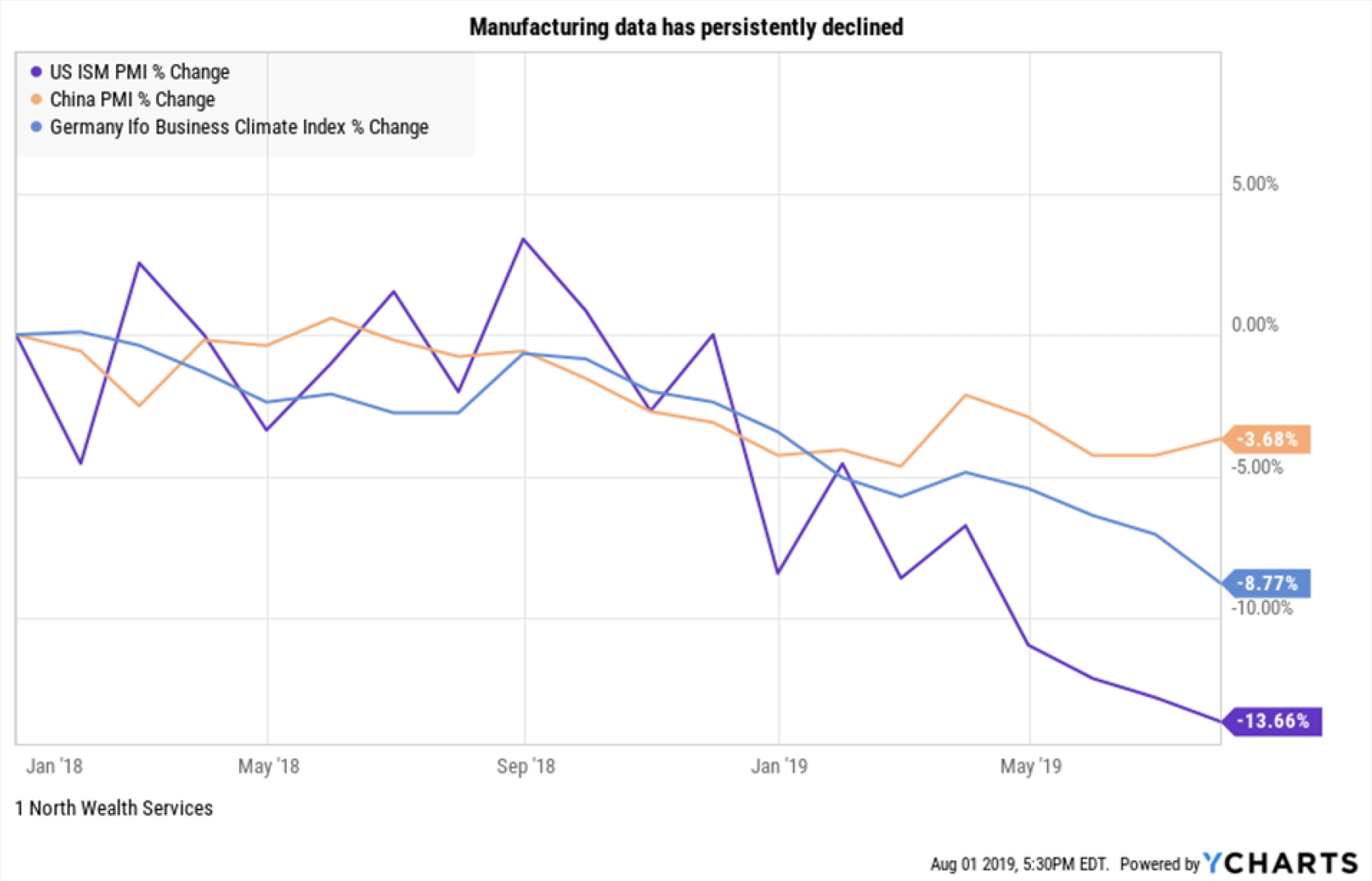

The Fed’s rate cut on July 31st and support for further cuts if needed have recently moved the U.S. stock indices to their new highs; however, uncertainties are rising on multiple fronts. These issues include the trade tension with the world’s second largest economy, China, the aggravated military confrontation in the Middle East, the potentially hard Brexit, and the deceleration of growth in other major economies. As these uncertainties have not been adequately priced into the equity market, we believe that a significant market correction could follow in the coming months. In our view, equity investors have been too complacent, betting that the U.S. economy will dodge the economic weaknesses of the rest of the world through the Fed’s rate cuts. In fact, the U.S. economy is more synchronized to the world than expected. U.S. corporations have increasingly made their money abroad. Moreover, the larger stake is that a major part of the supply chain of U.S. consumers’ favorite products is built in China. In response to a new and more stiffened relationship with China, the global supply chain could be permanently restructured, causing an immediate short-term shock to the global economy. Business investments at home would be held up due to outlook uncertainties. It is increasingly likely that the U.S. economy could stall. The bond market has been sending the stress signal for months. The 10-year-3-month yield curve (a line graph mapping the relation of the interest rate on a U.S. Treasury 10-year bond and that on a 3-month Treasury note) has been inverted since May 15th, a signal that had typically preceded previous recessions. The probability of recession, measured by the yield curve inversion, has rapidly risen since December 2018. It has now reached 33%, the level that predicted 9 out of the previous 10 recessions, with an average of 9 months in advance. Whether the bond market or the equity market is correct in its forecast remains to be seen, but manufacturing data (reflected in purchasing managers index) has persistently declined in the U.S. since April, and in China and Europe for over a year. Some might argue that the U.S. economy is two thirds composed of services, but the manufacturing sector hires and therefore generates the income that fuels the service sector. In addition to weakening manufacturing sector, existing home sales, despite all-time low interest rates, have remained sluggish after a temporary spike in February.

So, the question now is whether cheaper money, being supported by the Fed, is enough for the real economy to turn around. There are, in fact, lessons to be learned from Japan and Germany’s experiences. Businesses in those countries have been able to borrow money for free or even get paid to borrow (as reflected in the negative 10-year yield) for years, yet still economic growth remains sluggish. In this late stage cycle, we see less of a case to bet on the rising equity market and more of a case to be defensive. We forecast that interest rates will be stuck in the lower rate environment for longer. We have been making changes to your portfolios since last November by diversifying into investments that do not correlate directly to market movement, such as gold and real estate. During this time, we have added investments, such as utilities, that add income and lower the risk level of your portfolio. We have also locked into the current interest rate of long-term treasury bonds and moved away from the higher credit risk bonds. We are always available to address your questions on your investments or our overall market outlook.▲

Please remember that past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by 1NWS), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from 1NWS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. 1NWS is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of 1NWS’s current written disclosure statement discussing our advisory services and fees is available upon request.