Warren Buffet said it best: “Be fearful when others are greedy. Be greedy when others are fearful.” Investor sentiment is defined as the overall attitude of investors toward a particular security or financial market. It is the feeling or tone of the market, or crowd psychology, as revealed through the activity and price movement of the securities trading in that market (www.investopedia.com June 25, 2019).

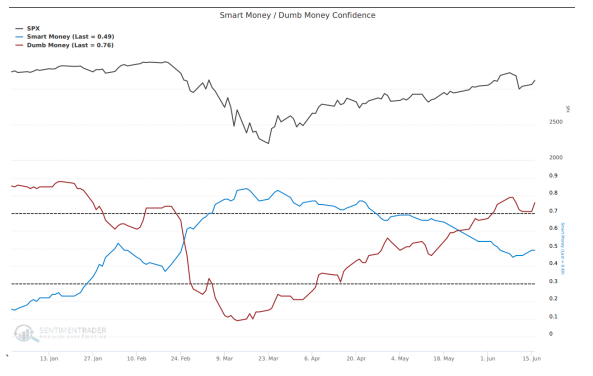

Investor sentiment is at a pre-pandemic high, but what is driving this optimism? Although we are not a big fan of the name, the following chart is a good representation of the confidence levels of Smart Money (institutional traders) vs. Dumb Money (small retail traders) investing year-to-date. Dumb Money tends to be bullish after a market rally and bearish after the market falls. When the Dumb Money indicators are extremely optimistic, as they are now, stocks usually run into trouble. Smart Money investors want to stay away from the market when Dumb Money indicators are extremely high. “Be fearful when others are greedy.”

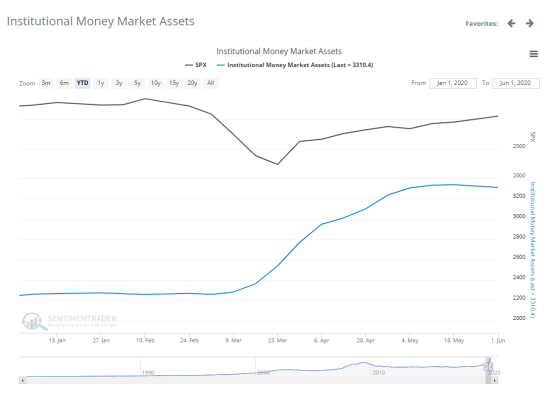

Smart Money is currently sitting in money market assets, waiting for the market extremes to subside. “Be greedy when others are fearful.”

In our view, the market was extremely overbought during the last half of 2019. Throughout this period, we methodically took gains off riskier positions and used the cash to invest in more defensive positions in your portfolio. As the 2019 U.S. markets continued to reach new highs in January and February, our thoughts were that this rally was not a reflection of what was going on globally in the markets. We became concerned about the impact that the coronavirus could have near-term on the U.S. economy and thus the market. In February, we decided that we would reduce positions that would be affected by market risk and increase our defensive positions in gold, treasuries, utilities, consumer staples, investment grade credit as well as short positions in the S&P 500 and the Russell 2000. These defensive positions do not correlate to market movement, so they helped to smooth out the market volatility and minimize losses in your portfolio during the extreme downturn. Although we did not completely exit the market, the increase of defensive positions turned out to be timely.

In March, the American economy slammed the brakes on the 128-month economic expansion. The Fed acted quickly with asset purchases and the government fiscal stimulus pumped the market full of liquidity. This would lead you to believe that the market would be healthy. That is not the case. Without aggressive Fed intervention, we would have rapidly fallen into a depression. While May’s unemployment and retail sales indicators were positive, they are still well below where we were pre-pandemic.

Market breadth is a stock market index (S&P 500, Dow, Nasdaq) indicator that measures the number of stocks rising in an index against the number of stocks falling in the same index. A strong market will have more stocks advancing in the index, than falling. Currently, the market breadth is negative, meaning that there are only a few stocks holding up the markets. In this case, the five companies that make up approximately 18% of the S&P 500, Facebook, Apple, Amazon, Netflix and Google (FAANG) have led the market higher. This makes sense because during the pandemic lockdown, these companies’ services were critical.

With the market pullback in March we looked to positions that would gain value coming out of the pandemic. Positions in biotech, medical devices, clean energy, cybersecurity, old technology, and emerging technologies such as robotics, artificial intelligence, were added. To have cash available for future opportunities, we took gains off some positions prior to the June 11th pullback.

The stock market is forward looking, and the economy is backward looking. With that in mind, you cannot ignore either. U.S. households are now purchasing about 60% of their goods and services online. This is up about 10% from 2019. As the economy starts to open and people resume their usual activities, the societal changes that the pandemic prompted, will continue to drive online business. The demand from both businesses and households will accelerate technology spending in cybersecurity, cloud computing, e-commerce, and communication services. Retail brick and mortar will continue to suffer. As Smart Money starts moving into the market, we will be cautiously opportunistic with positions that reflect the future of technology, as well as innovative healthcare in the U.S. and globally.

The U.S. debt-to GDP ratio is 110% (Federal Reserve Bank of St. Louis. “Federal Debt: Total Public Debt as Percent of Gross Domestic Product.” Accessed June 3, 2020.) This debt level could not be sustained with an increase in interest rates; therefore, interest rates will remain near 0%, with little increase in inflation until possibly 2022.

Fed monetary and fiscal policies have played a crucial role in buoying up the economy during this pandemic recession. Despite these actions, we won’t return to “normal” quickly. Until there is a vaccine, businesses and consumers will have to adapt to a world where personal interactions will present health risks. Our highest purpose as your investment advisors is to help you to reach your life goals by capturing the upside and limiting the downside of the market. We will continue to research and invest in positions that will help you to reach your goals, safely and with minimal volatility.